L-pesakond sündinud

Featured

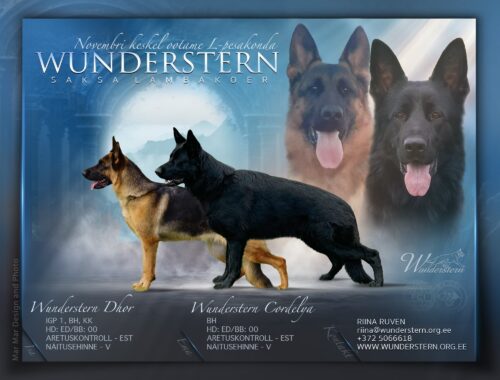

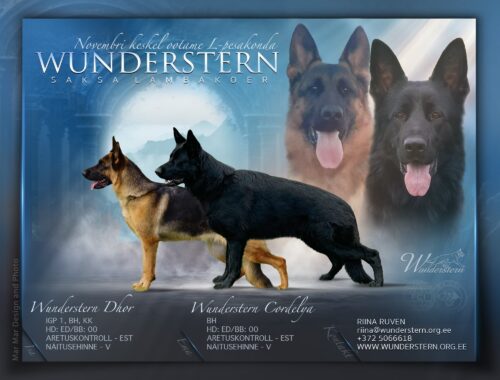

Kutsikad sündimas

Featured

Featured

Aretuskontroll 13.09.2024

Featured

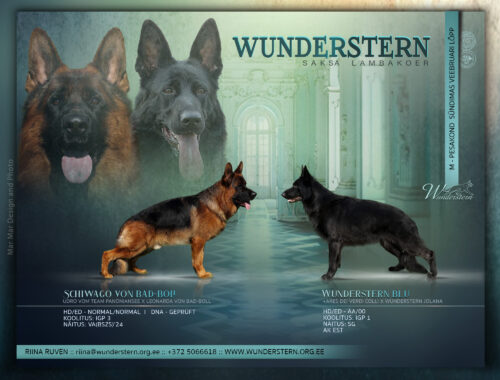

K-pesakond sündis 02.03.2024

Featured

J-pesakond on sündinud

Featured

ARTICUS kutsikanäitus, TSB ja IGP-C võistlused

Featured

14.10.2023 ARTICUS kutsikanäitus, TSB ja IGP-C võistlused

Kohtunik Bernd Nagel (Saksamaa)

Varrukamehed Sten Lõhmus js Artjom Trefov

Veteranid emased

2. koht Wunderstern Yella

Kutsikad 4-6 kuud emased

VL1 Wunderstern Ida

Kutsikad 6-8 kuud isased

VL1 Wunderstern Halt

VL2 Wunderstern Hondo

VL3 Wunderstern Haaland

VL4 Wunderstern Gabriel

Kutsikad 6-8 kuud emased

VL1 Wunderstern Hemy

Kutsikad 6-8 kuud emased pikakarvalised

VL1 Wunderstern Havanda

Näituse parim kutsikas

4-6 kuud kutsikad

2-3.koht Wunderstern Ida

6-8 kuud kutsikad

1.koht Wunderstern Halt

2.koht Wunderstern Hemy

3.koht Wunderstern Havanda

TSB võistlus

Isased koerad

1.koht Wunderstern Bruno 5/4,5

2.koht Wunderstern Winston 4/4

3.koht Wunderstern Watson 3/4

Emased veteranid

1.koht Wunderstern Vera 4,5/4,5

Emased koerad

3.koht Wunderstern Thalissa 4/3,5

IGP-1 C-katse võistlus

1.koht Wunderstern Bruno 98 punkit

5.koht Wunderstern Verona 92 punkti

PALJU ÕNNE KÕIGILE!

Läti peaerinäitus 2023

Featured

23.-24.09 LÄTI peaerinäitus, kohtunik Marc Renaud (Prantsusmaa)

Veteranid

V2 Wunderstern Yella

4-6 kuud isased

VV 1 Wunderstern Hondo

VV4 Wunderstern Isaco

4-6 kuud pikakarvalised emased

VV1 Wunderstern Havanda

VV 7 Wunderstern Ida

18-24 kuud isased

SG2 Wunderstern Drif

SG3 Wunderstern Dhor

Kasutusklass

V8 Wunderstern Thalissa

Kutsikad aprillis 2023

Featured

ESLÜ peaerinäitus 2022

Featured

18.-19.06.2022 ESLÜ peaerinäitus Tagadil, kohtunik Nikolaus Mesler (SV)

4-6 kuud

VL1 Wunderster Dhor

VL8 Wunderstern Dess

veteranid

V2+Vet SERT Wunderstern Vera

avaklass

SG2 Wunderstern Webber

SG3 Wunderstern Phoenix

SG4 Wunbderstern Pippa

SG5 Wunderstern Penelope

18.-19.06 ESLÜ peaernäitus Tagadi, kohtunik Nikolaus Meßler (SV)

4-6 kuud

VL1 Wunderstern Dhor

VL8 Wunderstern Dess

Veteranid

V2+Vet SERT Wunderstern Vera

Avaklass

SG2 Wunderstern Webber

SG3 Wunderstern Phoenix

SG4 Wunderstern Pippa

SG5 Wunderstern Penelope

12-18 kuud

SG6 Wunderstern Bruno

SG8 Wunderstern Clif

SG3 Wunderstern Blu

SG8 Wunderstern Bayla

SG14 Wunderstern Cassandra

SG15 Wunderstern Cordelya

SG2+Jun SERT Wunderstern Cessylia

Kasutusklass

SG1 Wunderstern Scarlett

Parim emane varrukakoer Wunderstern Scarlett